Getting preapproved is likewise important due to the fact that you'll understand exactly how much money you're authorized to borrow." With preapproval in hand, you can begin seriously searching for a property that satisfies your requirements. Take the time to search for and select a house that you can envision yourself residing in. When you discover a house that has the perfect mix of price and livability, however, attack rapidly.

" Spend time analyzing the housing stock, and be prepared to move rapidly when your house that meets your requirements goes on the market." Use social media and ask your representative for leads on homes going on the market before they are listed on the MLS," Bardos also recommends. If you have actually found a house you're interested in acquiring, you're ready to finish a home loan application.

The lending institution may require you to submit numerous documents and information, including: Recent income tax return, pay stubs and other proof of earnings (e - what is today's interest rate for mortgages. g., perks and commissions, overtime, Social Security) Employment history from the past 2 years Financial statements from your bank and other assets, such as pension or CDs The loan provider will likewise pull your credit report to validate your creditworthiness.

The decision will originate from the lender's underwriting department, which examines the danger of each potential borrower, and figures out the loan quantity, how much the loan will cost and more." After all your financial details is gathered, this info is submitted to an underwriter a person or committee that makes credit determinations," explains Bruce Ailion, an Atlanta-based realty attorney and Realtor.

After you make an offer on a home, the loan provider will perform an appraisal of the residential or commercial property to identify whether the quantity in your deal is proper. The assessed value depends upon many aspects, including the house's condition and comparable residential or commercial properties, or "compensations," in the neighborhood. A title business will perform a title search to guarantee the property can be moved, and a title insurance company will issue an insurance plan that ensures the accuracy of this research study.

When you've been officially approved for a home mortgage, you're nearing the goal all that's needed is to finish the closing, which is when you'll pay closing expenses." The closing process differs a bit from state to state," Ailion states. "Generally it involves confirming the seller has ownership and is authorized to transfer title, figuring out if there are other claims versus the property that should be paid off, gathering the cash from the purchaser, and distributing it to the seller after subtracting and paying other charges and costs." The closing costs you're responsible for can consist of: Appraisal fee Credit check cost Origination and/or underwriting cost Title services fee In the closing process, the closing representative will provide a detailed statement to the celebrations of where the cash originated from and went.

See This Report about When Did 30 Year Mortgages Start

They state you shouldn't put the cart prior to the horse. The very same is real in the homebuying procedure. You'll need to complete several steps to obtain a home mortgage, so the more you find out about what's required, the much better notified your decision-making will be. And if you're rejected a loan?" If you are not able to get approved for a loan with favorable terms, it may make more sense to merely wait until you can make the essential modifications to improve your credit rating prior to trying again," Griffin recommends.

If what is a timeshare and how does it work you were to have your sights set on a new home, however you learned that in order to buy it, an unique "death pledge" belonged to the offer, you 'd probably run far, far in the other direction. Just the words "death pledge" can send out shivers down your spinal column.

It summons all sorts of images, like haunted homes, or cursed homes developed on top of sacred burial grounds or located on a sinkhole. Your house with the death promise on it is the one trick or treaters are too afraid to go near on Halloween. A house is a location you're expected to promise to reside in, not die.

In this case, when you obtain cash to purchase a home, you make a promise to pay your loan provider back, and when the loan is paid off, the pledge dies. Odd referrals aside, how well do you actually understand the rest of your mortgage essentials? It is very important to know the ins and outs of the financing procedure, the difference in between fixed and variable, primary and interest, prequalification and preapproval.

So, with that, we prepared miami timeshare rentals this basic primer on home loans and mortgage. A home mortgage is a home loan. When you pick a house you 'd like to purchase, you're enabled to pay for a part of the cost of the home (your down payment) while the lender-- a bank, cooperative credit union or other entity-- lets you obtain the remainder of the money.

Why is this procedure in place? Well, if you're rich enough to http://spencerdnzu017.over-blog.com/2021/03/not-known-facts-about-who-does-usaa-sell-their-mortgages-to.html pay for a house in cash, a mortgage does not need to be a part of your financial vernacular. But homes can be costly, and many people can't manage $200,000 (or $300,000, or $1 million) in advance, so it would be impractical to make you pay off a home prior to you're enabled to relocate.

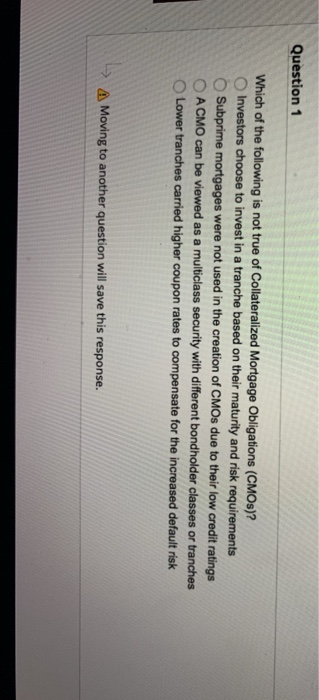

A Biased View of Which Of The Following Is Not True About Reverse Annuity Mortgages?

Like the majority of loans, a home loan is a trust between you and your lender-- they have actually delegated you with money and are trusting you to repay it. Should you not, a secure is taken into place. Until you pay back the loan completely, your house is not yours; you're just living there.

This is called foreclosure, and it's all part of the contract. Home loans are like other loans. You'll never borrow one lump sum and owe the precise amount provided to you. what are the different types of mortgages. 2 ideas enter into play: principal and interest. Principal is the primary amount obtained from your loan provider after making your down payment.

How good it would be to take thirty years to pay that cash back and not a penny more, but then, loan providers would not make any cash off of providing cash, and hence, have no reward to work with you. That's why they charge interest: an extra, continuous expense charged to you for the chance to borrow money, which can raise your monthly mortgage payments and make your purchase more costly in the long run.

There are two kinds of home loan, both defined by a different rates of interest structure. Fixed-rate home mortgages (FRMs) have an interest rate that stays the same, or in a set position, for the life of the loan. Traditionally, mortgages are offered in 15-year or 30-year payment terms, so if you get that 7-percent fixed-rate loan, you'll be paying the same 7 percent without change, regardless if rates of interest in the wider economy rise or fall over time (which they will).